The Special Purpose, Local Option Sales Tax (SPLOST) remains in a good position to continue being able to help provide for local governments despite a downturn in the nation’s economic fortunes during the continued COVID-19 pandemic, and distributions are even on an uptick based on economic data from the state.

Distributions statewide in June 2020 totaled up to $160,648,299 for SPLOST, an $18 million-plus increase compared to May 2020, where the figure stood at $142 million and was down 3.7% from the previous month.

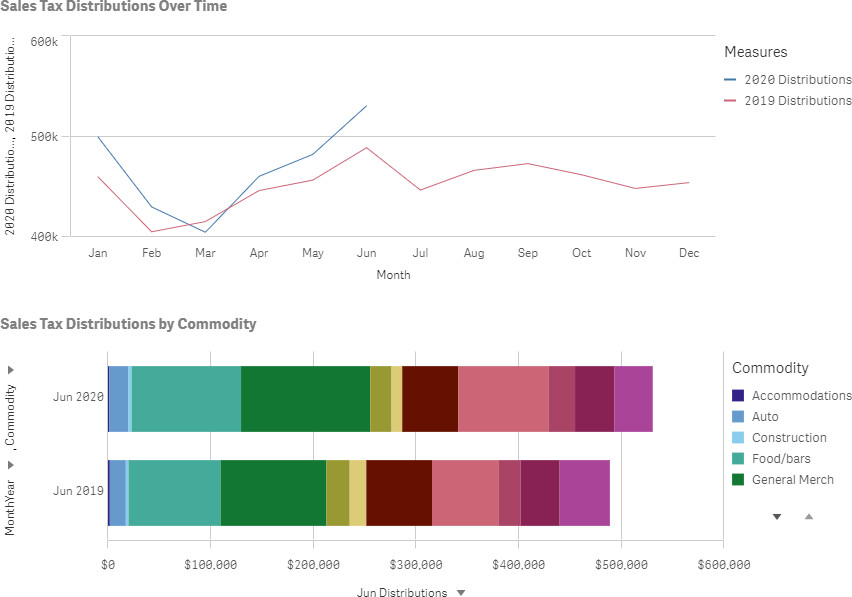

Locally in Polk County, the collections stood at $530,576 for the month of June, a 10% increase from May’s $482,245 in SPLOST collections, which are up from previous months. Compared to last year, that’s $41,000-plus more coming in to local governments to use for a variety of projects, new vehicles, equipment and more. That accounted for an 8.5% increase from June 2019.

Terry Schwindler, the President and CEO of the Development Authority of Polk County, pointed to the SPLOST distributions as a positive indicator for the local economy and the impact that COVID-19 had on economic growth.

“The data shows that the Polk County 2020 local sales tax collections for March were only down 3.2% from the 2019 figures, April 2020 collections were up 3.2% over 2019, and May 2020 collections were up .1% over 2019,” she said. “Polk County fared much better than many other counties in Georgia due to our high concentration of companies in the manufacturing industry.”

Overall, the SPLOST collections indicate as well that some of the planned economic stimulus money given in the CARES Act have circulated through the local and state economy in the form of sales taxes at stores, though the two largest sectors to benefit from the increased spending were in restaurants and bars, and in general merchandise.

Sales taxes locally for restaurants amounted to more than $106,000, and for stores selling general merchandise items came in around $125,825 in sales taxes. An additional $87,596 was generated in miscellaneous retail sales as well.

Large percentages of general retail sales and food service collections make up SPLOST distributions locally throughout the life of the SPLOST. In 2019 alone, general merchandise sales made up 21% of total SPLOST collections, and food purchases from restaurants and bars accounted for 19% of the revenue generated for the penny tax added to bills.

The Education SPLOST approved by voters to help pay for new school buildings have also seen increased collections the past year. A total of $535,695 was taken in from the penny sales tax to pay for education projects, equipment and more in the Polk School District, compared to the $474,274 taken in during June 2019. That’s a 13% increase in revenue from the E-SPLOST, or an increase of more than $61,000.

Leave a Reply