Referendum approval by voters needed, County gives 3-2 thumbs up

The City of Cedartown is seeking a new item for their economic development toolbox to lure companies to invest in Polk County, especially those offering a variety of commercial opportunities for growth along certain corridors.

A Tax Allocation District (TAD) is essentially what it sounds like: an area where typical property taxes for businesses are handled differently than other areas already established and developed within the city limits. In this case, the district would have a baseline tax value for those investors willing to come in and create new developments, with the Northern TAD being proposed as a good example of what the city is trying to accomplish.

Local governments will still receive the baseline tax revenues while any increases in value from future developments will be earmarked to further improving the district for a designated amount of time, or be used to pay off a bond used to create the TAD.

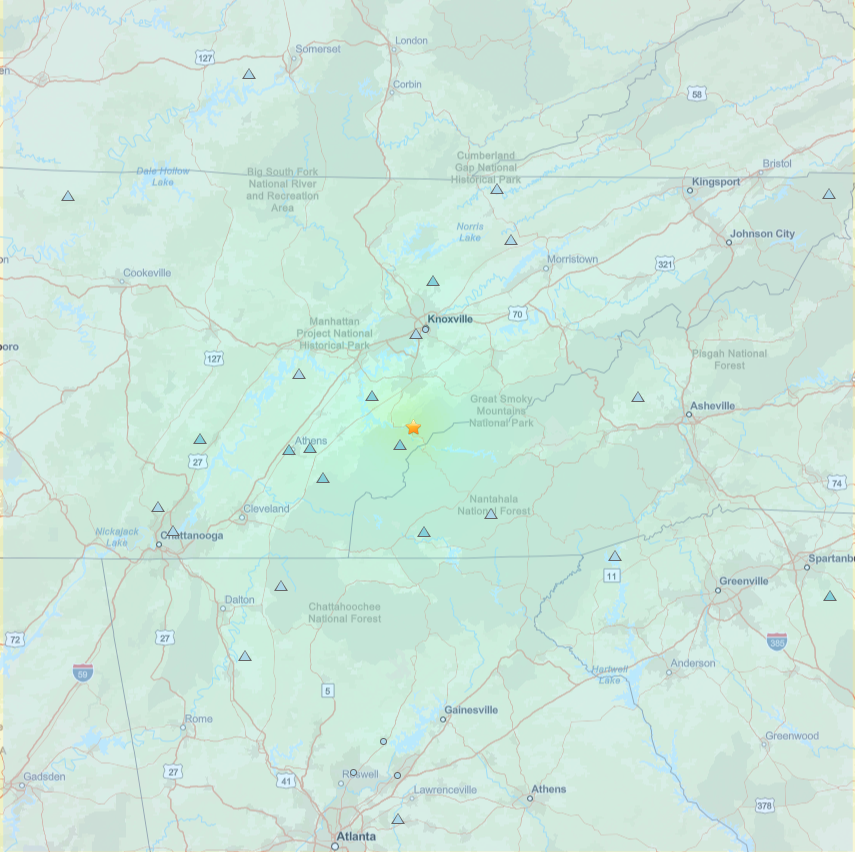

Cedartown City Manager Edward Guzman explained that the Northern TAD (see map above) would be placed in a special zone that would collect baseline taxes for the specific parcel under consideration, while increasing property tax values through a certain period of time (say for instance a minimum of 10 years, and a maximum of 25 years.) The additional revenue gained from property tax increases because of values for property going up are reinvested via a special collection fund based on what the TAD generates over time, outside of the general fund.

When it expires, the revenue goes back toward the general fund balance. TADs still allow for increases in millage rates in property taxes or decreases as needed.

The property being looked at for a TAD across from Home Depot in Cedartown essentially would increase in value over time on the register with new development – one already being sought through an economic development opportunity only known at the moment as “Project Winter.” The investment also helps the entire corridor as property values increase overall, and drive more traffic to other businesses increasing revenue opportunity for all. The Northern TAD would include existing properties with businesses on them as well, meaning that collections could begin immediately on the property taxes once the TAD is established.

So in this particular case as an example, The Home Depot’s current value as a commercial property on the tax rolls would be set in place, and though the value of the property would go up and their taxes collected normally, the taxes collected on the increased value is set aside in the TAD fund. The new “Project Winter” the TAD would be based around comes with the opportunity to increase values dramatically with development, as well as future redevelopment of areas.

“The land that “Project Winter” is on is currently assessed at $175,893. So their tax bill is somewhere around $2,000 from all 3 entities,” Guzman explained further. “Let’s say Project Winter’s fully built project is worth $30 million in 2027. That difference in property taxes would go into the TAD fund. If a bond is taken to help get the project done, that money is then used to pay the bond off. The school district, county, and city would then receive the full benefit of new sales tax that would not have happened without the TAD.”

City officials have two areas – the Northern TAD described above and a downtown area to be further defined in hopes of gaining new development opportunities, but they need two things to happen first: local legislation to go through the State House and Senate to get it up for a voter’s referendum this year, and support locally when projects come up for approval from the County and Board of Education, both who have to partner when tax-related enhancements are being considered.

“A TAD for commercial projects has the potential to allow for smart, controlled growth so that Polk County residents don’t have to travel to another community to get what they need,” Guzman said.

Guzman presented the plan to the County Commission during a special called session on Wednesday, and they considered a non-binding vote to support the effort to head to the Gold Dome for further work. The 3-2 vote supporting the measure doesn’t mean it is going to happen just yet, but it does have the support of the current Board of Commissioners to be considered for a future ballot if the local legislation gets passed.

Commissioners Chuck Thaxton and Ray Carter voted against the Tax Allocation District request, but since it was a non-binding resolution their nays held little sway over whether the city would be moving forward with the request without the county’s approval.

TADs do have a proven track record for bringing new business to cities in the surrounding area. The redevelopment of the old Kmart in Rome where several restaurants and national retailers have anchored business on Turner McCall Boulevard was redeveloped using a TAD, and the East Main Street Kroger in Cartersville turned a blighted area into a thriving commercial district.

The hope is the use of TADs in Cedartown will drive that kind of development in the near and far future. Guzman pointed out in his presentation that thanks to a tool called Placer.AI, they were able to find that Polk County overall is missing out on shopping trips made by local residents to other communities since local options aren’t matching those of Rome, the I-20 corridor in Haralson County, along with Paulding and Bartow Counties and therefore are giving up sales tax dollars that could be better used by city and county government.

Totaling up between all the Polk County residents to around 250,000 shopping trips that could have been done locally if the right mix of economic tools were at local government’s disposal.

Heading into the New Year, Guzman said there’s still plenty of work to be done before the possibility of a TAD can be a new tool.

First, the TADs have to get onto the ballot as a referendum for all local voters to decide if they want to allow it or not. That’ll require local legislation to pass the State House and State Senate, and then be signed by Governor Brian Kemp before it can end up as a local referendum for vote.

After that, it’ll be a case-by-case basis for establishing a TAD, and will still require City Commissioners, County Commissioners and School Board members to all agree to move forward before something like “Project Winter’s” Tax Allocation District could be done.

There’s good reason to use a TAD for such a project, per Guzman. Usually it is a combination of factors – costs would be prohibitive because of site issues, or construction cost increases, or having to develop infrastructure on the site like water and sewer.

It’ll be an acorn planted late in 2024 that will hopefully grow up into something taller by 2026.

Leave a Reply